Alaska Air Group operates two airlines, Alaska Airlines, Inc. (Alaska) and Horizon Air Industries, Inc. (Horizon). Co. also includes McGee Air Services, an aviation services provider. Co. has three operating segments: Mainline, which includes scheduled air transportation on Alaska's Boeing and Airbus jet aircraft for passengers and cargo throughout the U.S., and in parts of Mexico, Costa Rica and Belize; Regional, which includes Horizon's and other third-party carriers' scheduled air transportation for passengers across a shorter distance network within the U.S. and Canada under capacity purchase agreements (CPA); and Horizon, which includes the capacity sold to Alaska under a CPA.

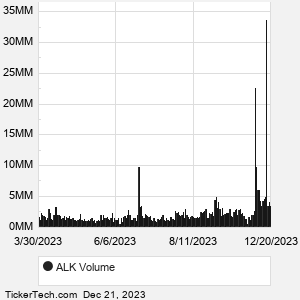

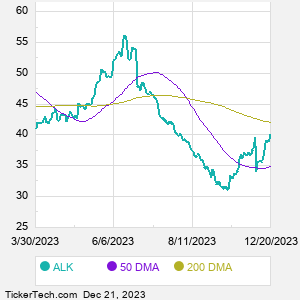

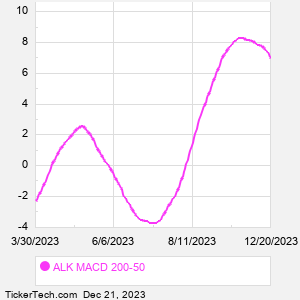

When researching a stock like Alaska Air Group, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from ALK Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for ALK stock — the real life supply and demand for the stock over time — and examines that data in different ways. |