A.O. Smith manufactures and markets residential and commercial gas and electric water heaters, boilers, tanks and water treatment products. Co. has two segments: North America and Rest of World. Co.'s Rest of World segment is mainly comprised of China, Europe and India. In North America, Co. serves residential and commercial end markets with a range of products including: water heaters, boilers, water treatment products, and other, which consists of expansion tanks, commercial solar water heating systems, swimming pool and spa heaters, related products and parts. The Chinese water heater market comprises of electric wall-hung, gas tankless, combi-boiler, heat pump and solar water heaters.

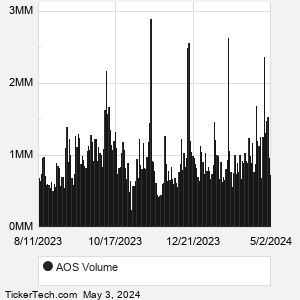

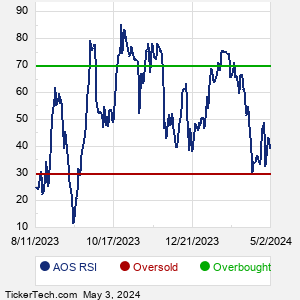

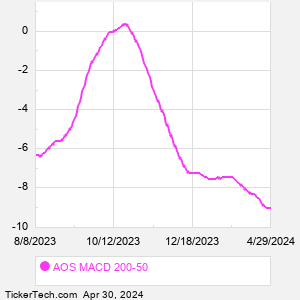

When researching a stock like A O Smith, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from AOS Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for AOS stock — the real life supply and demand for the stock over time — and examines that data in different ways. |