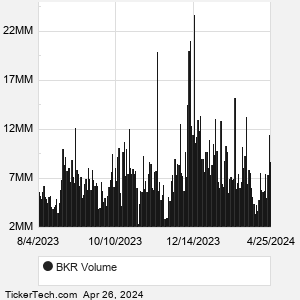

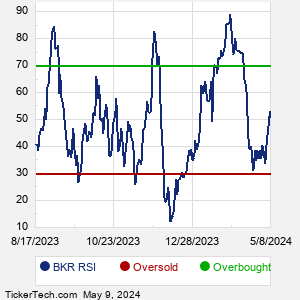

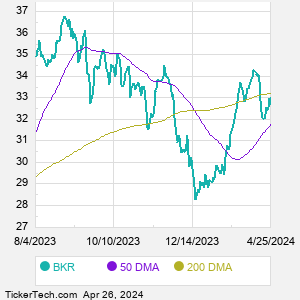

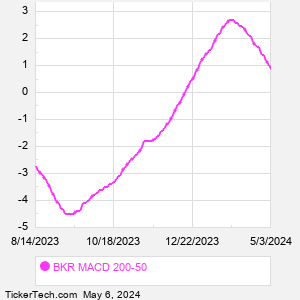

| BKR Technical Analysis Data | ||||||||||||||||

Also see: |

| BKR Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| BKR Stock Price Chart |

| Technical Analysis News |

NXPI Makes Notable Cross Below Critical Moving Average Amerisafe (AMSF) Shares Cross Above 200 DMA First Advantage Breaks Above 200-Day Moving Average - Bullish for FA Notable Two Hundred Day Moving Average Cross - TTD Workday Breaks Below 200-Day Moving Average - Notable for WDAY TaskUs Breaks Above 200-Day Moving Average - Bullish for TASK RCKT Crosses Below Key Moving Average Level Nuvalent (NUVL) Shares Cross Below 200 DMA SBRA Makes Bullish Cross Above Critical Moving Average CHMG Makes Bullish Cross Above Critical Moving Average ONEQ Enters Oversold Territory PDP Crowded With Sellers FV Crosses Critical Technical Indicator LRGE Crowded With Sellers JTEK Getting Very Oversold |