Carnival is a leisure travel company with operations in North America, Australia, Europe and Asia. Co. operates in four segments: North America and Australia, which includes Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises (Australia), and Seabourn; Europe and Asia, which includes Costa Cruises, AIDA Cruises, P&O Cruises (UK), and Cunard; Cruise Support, which includes its portfolio of port destinations and other services; and Tour and Other, in which Co. owns Holland America Princess Alaska Tours, a tour company in Alaska and the Canadian Yukon that complements its Alaska cruise operations.

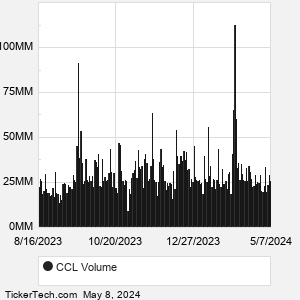

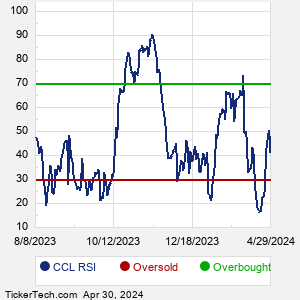

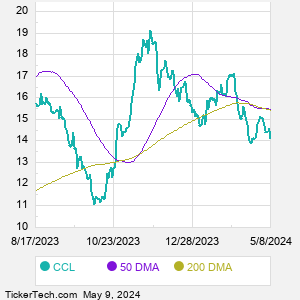

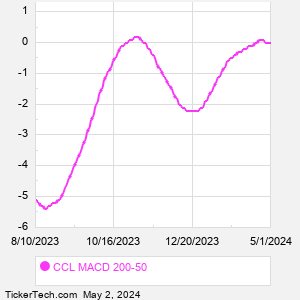

When researching a stock like Carnival, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from CCL Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for CCL stock — the real life supply and demand for the stock over time — and examines that data in different ways. |