Catalent is a holding company. Through its subsidiaries, Co. has two operating and reporting segments: Biologics and Pharma and Consumer Health. The Biologics segment provides development and manufacturing for biologic proteins; cell, gene, and other nucleic acid therapies; plasmid DNA; induced pluripotent stem cells; and vaccines. The Pharma and Consumer Health segment comprises Co.'s capabilities for oral solids, softgel formulations, Zydis® fast-dissolve technologies, and gummy, soft chew, and lozenge dosage forms; formulation, development, and manufacturing platforms for oral, nasal, inhaled, and topical dose forms; and clinical trial development and supply services.

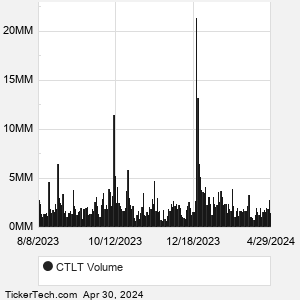

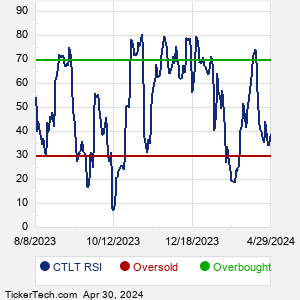

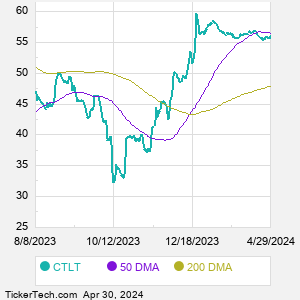

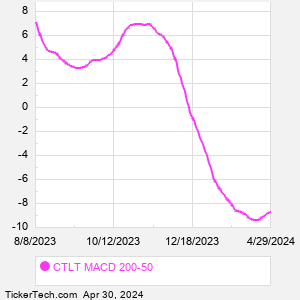

When researching a stock like Catalent, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from CTLT Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for CTLT stock — the real life supply and demand for the stock over time — and examines that data in different ways. |