| CRL Technical Analysis Data | ||||||||||||||||

Also see: |

| CRL Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CRL Stock Price Chart |

| CRL Technical Analysis Data | ||||||||||||||||

Also see: |

| CRL Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CRL Stock Price Chart |

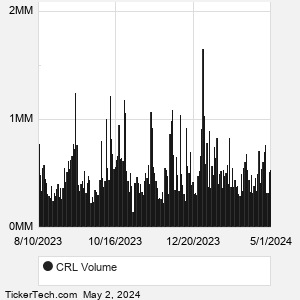

| CRL Technical Analysis Charts |

|

| About Charles River Laboratories International Inc. |

| Charles River Laboratories International is a full service, non-clinical global drug development partner. Co. has laboratory animal medicine and science (research model technologies) to develop a portfolio of discovery and safety assessment services, both Good Laboratory Practice (GLP) and non-GLP, that supports its clients from target identification through non-clinical development. Co. also provides a suite of products and services to support its clients' manufacturing activities, including its contract development and manufacturing organization business. Co. has three reporting segments: Research Models and Services, Discovery and Safety Assessment and Manufacturing Solutions. When researching a stock like Charles River Laboratories International, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from CRL Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for CRL stock — the real life supply and demand for the stock over time — and examines that data in different ways. |

| CRL Technical Analysis Charts |

|

| Video: Technical Analysis | |

|

| CRL Technical Analysis Peers |

| Charles River Laboratories International (CRL) is categorized under the Healthcare sector; to help you further research Technical Analysis, below are some other companies in the same sector:

CTLT Technical Analysis |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.