ConocoPhillips is an independent exploration and production company which explores for, produces, transports and markets crude oil, bitumen, natural gas, liquefied natural gas and natural gas liquids. Co.'s segments are: Alaska, which operates in Alaska; Lower 48, which operates in the U.S. states and the Gulf of Mexico; Canada, which operates in Alberta and British Columbia, Canada; Europe, Middle East and North Africa, which includes operations located in the Norwegian sector of the North Sea, the Norwegian Sea, and terminalling operations in the U.K.; Asia Pacific, which operates in China, Indonesia, Malaysia and Australia; and Other International, which includes activities in Colombia.

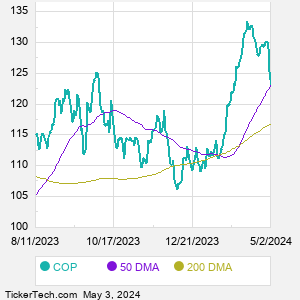

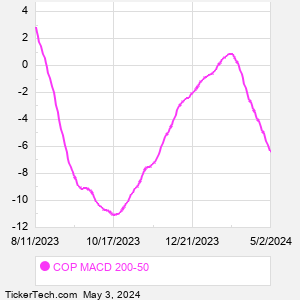

When researching a stock like ConocoPhillips, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from COP Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for COP stock — the real life supply and demand for the stock over time — and examines that data in different ways. |