Copart is a provider of online auctions and vehicle remarketing services. Co. provides vehicle sellers with a range of services to process and sell vehicles primarily over the internet through its Virtual Bidding Third Generation internet auction-style sales technology, which Co. refers to as VB3. Vehicle sellers consist primarily of insurance companies, but also include banks, finance companies, charities, fleet operators, dealers, vehicle rental companies, and individuals. Co. sells the vehicles principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, exporters, and to the general public.

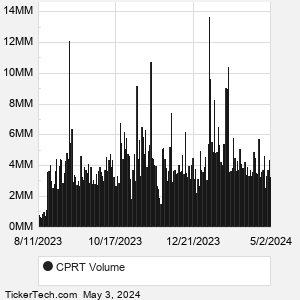

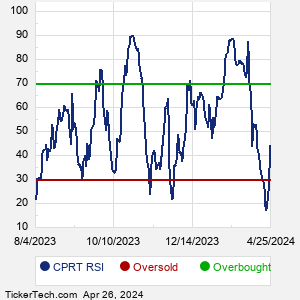

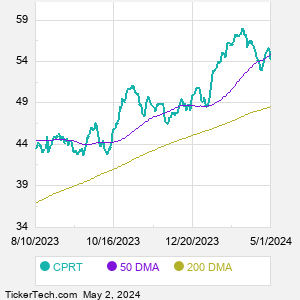

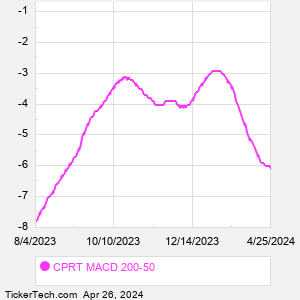

When researching a stock like Copart, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from CPRT Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for CPRT stock — the real life supply and demand for the stock over time — and examines that data in different ways. |