DuPont de Nemours provides technology-based materials and solutions. Co.'s segments include: Electronics and Industrial, which supplies differentiated materials and systems for a range of consumer electronics including mobile devices, television monitors, personal computers and electronics used in a variety of industries; Water and Protection, which provides engineered products and integrated systems for several industries including, worker safety, water purification and separation, transportation, energy, medical packaging and building materials; and Mobility and Materials, which provides engineering thermoplastics, elastomers, adhesives, silicone encapsulants, pastes, filaments and films.

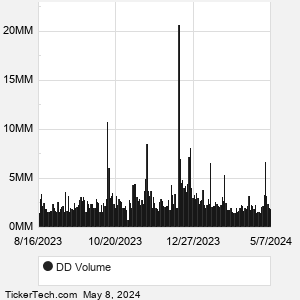

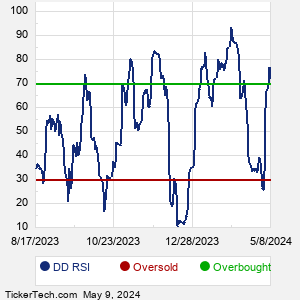

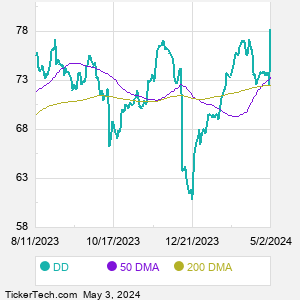

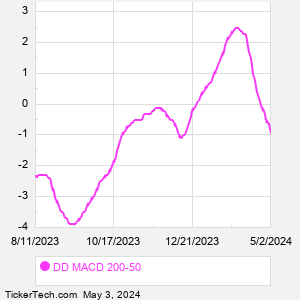

When researching a stock like DuPont, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from DD Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for DD stock — the real life supply and demand for the stock over time — and examines that data in different ways. |