Dover is a global manufacturer and solutions provider. Co.'s operating segments include: Engineered Products, which provides a range of equipment, components, software, solutions and services that have a range of customer applications across a number of markets; Clean Energy and Fueling, which provides components, equipment and software, and service solutions enabling safe storage, transport, handling and dispensing of fuels, cryogenic gases and other hazardous fluids; and Imaging and Identification, which supplies marking and coding, product traceability, brand protection and digital textile printing equipment, as well as related consumables, software and services.

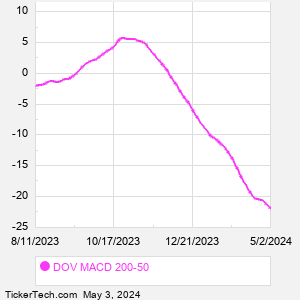

When researching a stock like Dover, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from DOV Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for DOV stock — the real life supply and demand for the stock over time — and examines that data in different ways. |