Ecolab is a provider of water, hygiene and infection prevention solutions and services. Co.'s cleaning and sanitizing programs and products and pest elimination services support customers in the foodservice, food and beverage processing, hospitality, healthcare, government and education, retail, textile care and commercial facilities management sectors. Co.'s products and technologies are also used in water treatment, pollution control, energy conservation, refining, primary metals manufacturing, papermaking, mining and other industrial processes. Co. has three reportable segments: Global Industrial, Global Institutional and Specialty and Global Healthcare and Life Sciences.

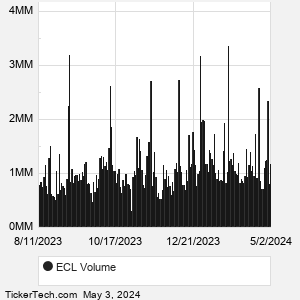

When researching a stock like Ecolab, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from ECL Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for ECL stock — the real life supply and demand for the stock over time — and examines that data in different ways. |