Edison International is a holding company. Through its subsidiary, Southern California Edison Company (SCE), which is an investor-owned public utility, Co. is engaged in the business of supplying and delivering electricity to southern California. Co.'s other subsidiary, Edison Energy, LLC, is engaged in the business of providing integrated decarbonization and energy solutions to commercial, institutional and industrial customers. SCE supplies electricity to its customers through transmission and distribution networks. Its transmission facilities, which are located primarily in California but also in Nevada and Arizona, deliver power from generating sources to the distribution network.

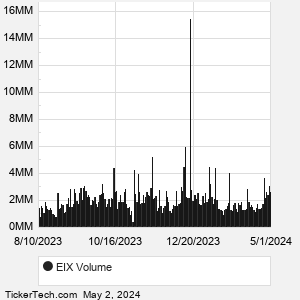

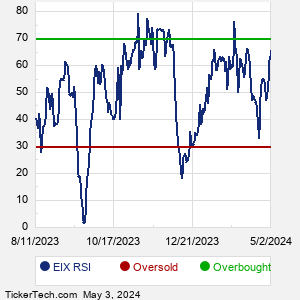

When researching a stock like Edison International, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from EIX Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for EIX stock — the real life supply and demand for the stock over time — and examines that data in different ways. |