Exxon Mobil operates or markets products in the U.S. and other countries of the world. Co.'s principal business involves exploration for, and production of, crude oil and natural gas and manufacture, trade, transport and sale of crude oil, natural gas, petroleum products, petrochemicals and a variety of specialty products. In the U.S., Co.'s development activities are focused on the onshore U.S., primarily in the Permian Basin of West Texas and New Mexico. Co. also has ongoing activities in Canada/Other Americas, Europe, Africa, Asia, as well as Australia/Oceania.

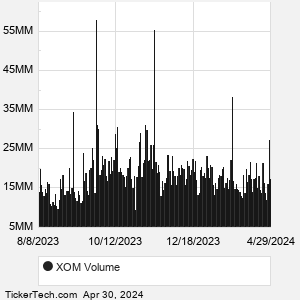

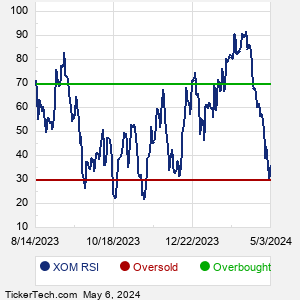

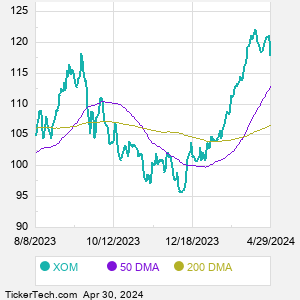

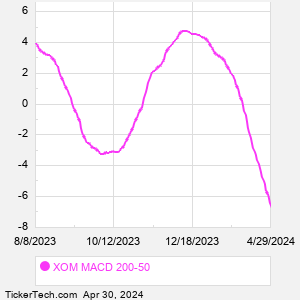

When researching a stock like Exxon Mobil, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from XOM Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for XOM stock — the real life supply and demand for the stock over time — and examines that data in different ways. |