Fortune Brands Home & Security is a holding company. Through its subsidiaries, Co. provides home and security products. Co.'s segments are: Plumbing, which manufactures or assembles and sells faucets, accessories, kitchen sinks and waste disposals; Outdoors & Security, which manufactures and sells fiberglass and steel entry door systems, storm, screen and security doors, composite decking, railing and cladding and urethane millwork, as well as manufactures, sources and distributes locks, safety and security devices, and electronic security products; and Cabinets, which manufactures custom cabinetry, as well as vanities, for the kitchen, bath and other parts of the home.

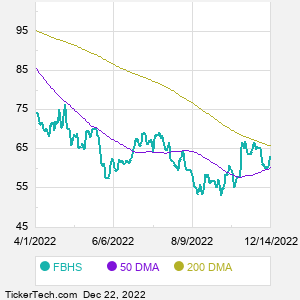

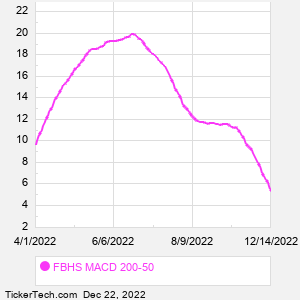

When researching a stock like Fortune Brands Home and Security, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from FBHS Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for FBHS stock — the real life supply and demand for the stock over time — and examines that data in different ways. |