FleetCor Technologies is a provider of digital payment solutions. Co. has three reportable segments, North America, International, and Brazil. Co.'s proprietary processing and card management solutions provide customers with capabilities including: customizable user-level controls, detailed transaction reporting, programmable alerts, configurable networks, contract price validation and audit, and tax management and reporting. Co.'s Corporate Payments solutions are designed to help businesses streamline the back-office operations associated with making outgoing payments. Co. provides integrated gift card program management and processing services, in both plastic and digital form.

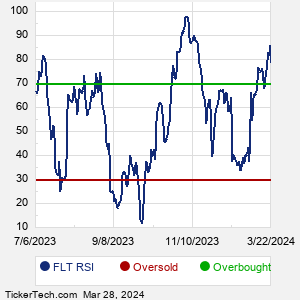

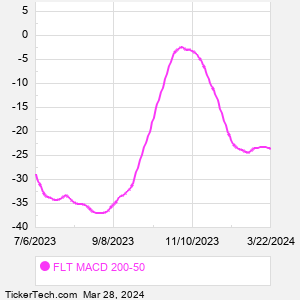

When researching a stock like FleetCor Technologies, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from FLT Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for FLT stock — the real life supply and demand for the stock over time — and examines that data in different ways. |