Howmet Aerospace provides engineered solutions for the aerospace and transportation industries. Co.'s segment are: Engine Products, which utilizes designs and techniques to support engine programs and produces components for aircraft engines and industrial gas turbines, including rolled rings; Fastening Systems, which produces aerospace and industrial fasteners, latches, bearings, fluid fittings and installation tools; Engineered Structures, which produces titanium ingots and mill products for aerospace and defense applications; and Forged Wheels, which manufactures forged aluminum wheels for trucks, buses, and trailers and related products for the global commercial transportation market.

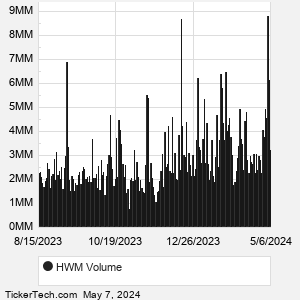

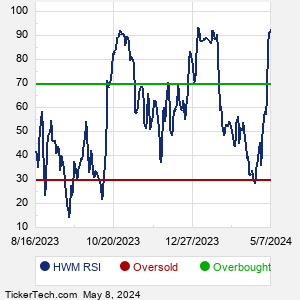

When researching a stock like Howmet Aerospace, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from HWM Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for HWM stock — the real life supply and demand for the stock over time — and examines that data in different ways. |