JPMorgan Chase is a financial holding company. Through its subsidiaries, Co. is a financial services firm. Co.'s segments include: Consumer and Community Banking, which provides services via bank branches, ATMs, digital (including mobile and online) and telephone banking; Corporate and Investment Bank, which consists of Banking and Markets and Securities Services that provides investment banking, market-making, brokerage, and treasury and securities products and services; Commercial Banking, which provides financial solutions, including lending, payments, investment banking and asset management products; and Asset and Wealth Management, which is engaged in investment and wealth management.

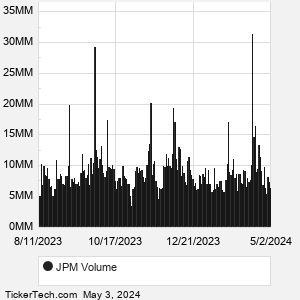

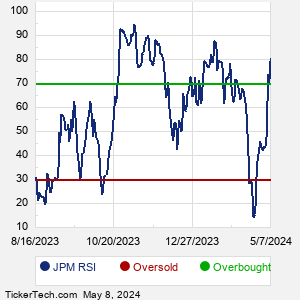

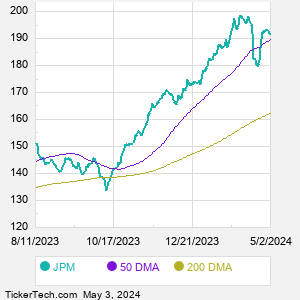

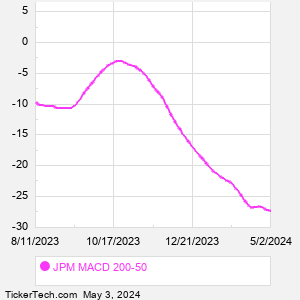

When researching a stock like JPMorgan Chase, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from JPM Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for JPM stock — the real life supply and demand for the stock over time — and examines that data in different ways. |