Kansas City Southern is a transportation holding company with domestic and international rail operations in North America. Co.'s subsidiary, The Kansas City Southern Railway Company, is a U.S. Class I railroad that serves several region in the midwest and southeast regions of the U.S. and has north/south rail route between Kansas City, MO and several main ports along the Gulf of Mexico in Alabama, Louisiana, Mississippi and Texas. Co.'s subsidiary, Kansas City Southern de Mexico, S.A. de C.V., operates a main commercial corridor of the Mexican railroad system and has as its main route a direct rail passageway between Mexico City and Laredo, TX.

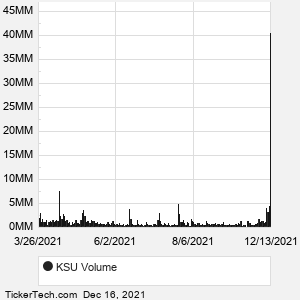

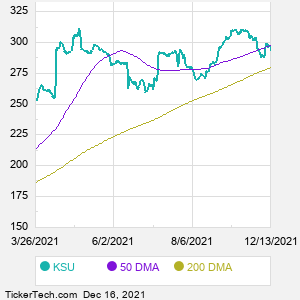

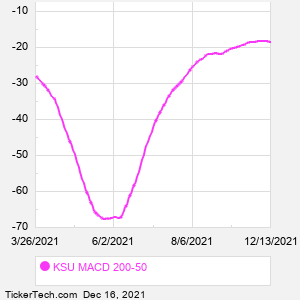

When researching a stock like Kansas City Southern, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from KSU Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for KSU stock — the real life supply and demand for the stock over time — and examines that data in different ways. |