Leidos Holdings is a holding company. Through its subsidiaries, Co. is a technology, engineering, and science company. Co. has three segments: Defense Solutions, which focuses on digital transformation, Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance technologies and services, transformative software, analytics, intelligence analysis, mission support and logistics services, weapons systems and human space exploration; Civil, which focuses on modernizing infrastructure, systems and security; and Health, which focuses on delivering solutions to federal and commercial customers that are responsible for the health and well-being of people worldwide.

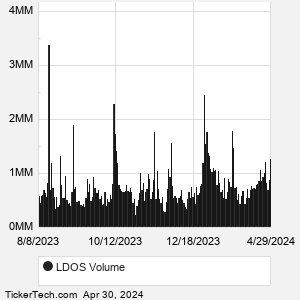

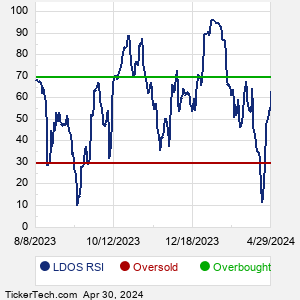

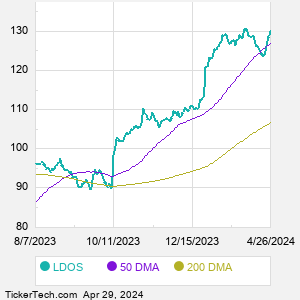

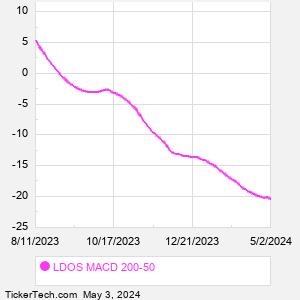

When researching a stock like Leidos Holdings, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from LDOS Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for LDOS stock — the real life supply and demand for the stock over time — and examines that data in different ways. |