Marriott International is an operator, franchisor, and licensor of hotel, residential, and timeshare properties under various brand names at different price and service points. Co. has two operating segments: U.S and Canada and International. Co.'s Luxury hotel brands include JW Marriott, The Ritz-Carlton, and St. Regis. Co.'s Premium hotel brands include Marriott Hotels, Sheraton, Delta Hotels, Marriott Executive Apartments, and Marriott Vacation Club. Co.'s Select hotel brands include Courtyard, Residence Inn, Fairfield, SpringHill Suites, Four Points, TownePlace Suites, Protea Hotels, Aloft Hotels, AC Hotels by Marriott, Element Hotels, and Moxy Hotels.

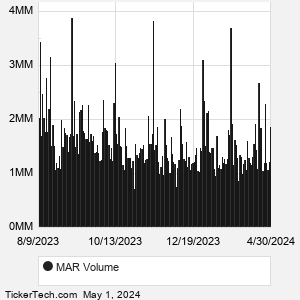

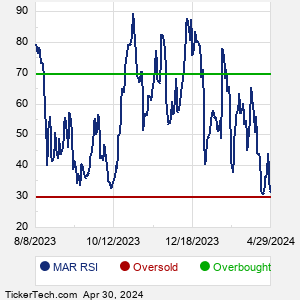

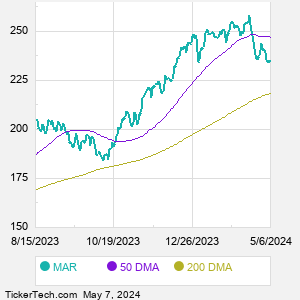

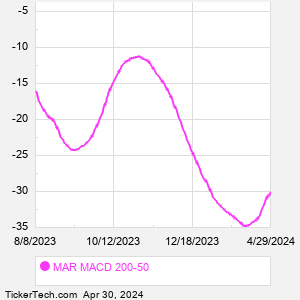

When researching a stock like Marriott International, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MAR Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MAR stock — the real life supply and demand for the stock over time — and examines that data in different ways. |