McDonald's franchises and operates McDonald's restaurants. Co.'s menu includes hamburgers and cheeseburgers, Big Mac, Quarter Pounder with Cheese, Filet-O-Fish, several chicken sandwiches, Chicken McNuggets, wraps, McDonald's Fries, salads, oatmeal, shakes, McFlurry desserts, sundaes, soft serve cones, bakery items, soft drinks, coffee, McCafé beverages and other beverages. Co.'s restaurants provides a full or limited breakfast menu, which may include Egg McMuffin, Sausage McMuffin with Egg, McGriddles, biscuit and bagel sandwiches, oatmeal, breakfast burritos and hotcakes. In addition to these menu items, the restaurants sell a variety of other products during limited-time promotions.

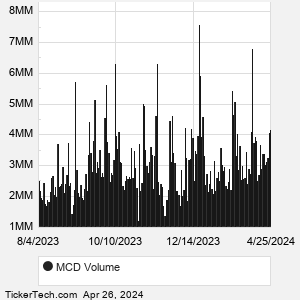

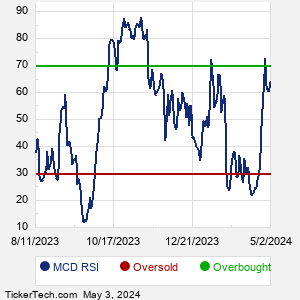

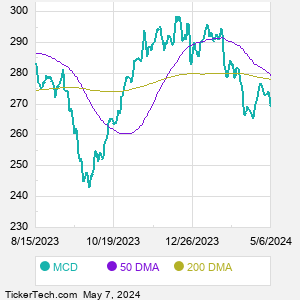

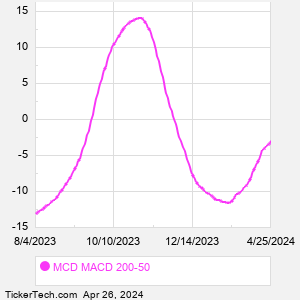

When researching a stock like McDonalds, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MCD Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MCD stock — the real life supply and demand for the stock over time — and examines that data in different ways. |