3M is a technology company. Co.'s reportable segments are: Safety and Industrial, which includes businesses in abrasives, automotive aftermarket, closure and masking systems, electrical markets, industrial adhesives and tapes, and personal safety; Transportation and Electronics, which includes advanced materials, automotive and aerospace, commercial solutions, display materials and systems, and electronic materials solutions; Health Care, which includes businesses in food safety, health information systems, medical solutions, oral care, and separation and purification sciences; and Consumer, which includes businesses in consumer health care, home care, and home improvement.

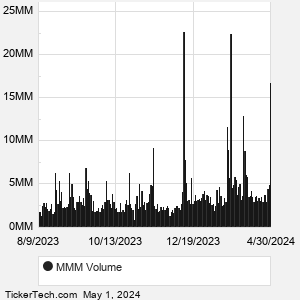

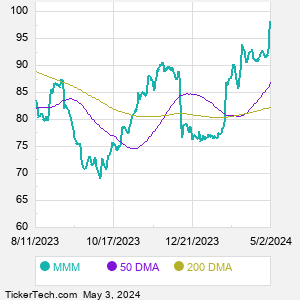

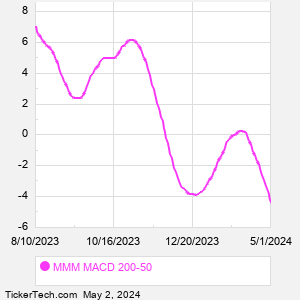

When researching a stock like 3M, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MMM Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MMM stock — the real life supply and demand for the stock over time — and examines that data in different ways. |