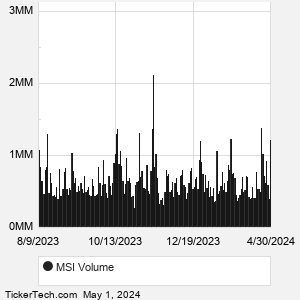

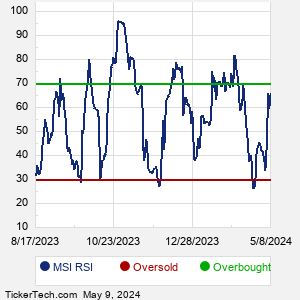

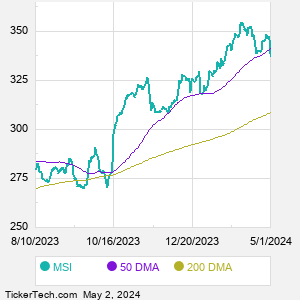

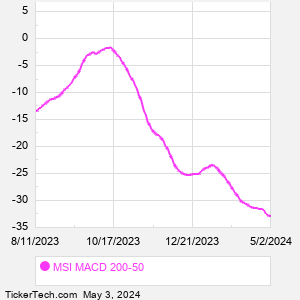

| MSI Technical Analysis Data | ||||||||||||||||

Also see: |

| MSI Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| MSI Stock Price Chart |

| MSI Technical Analysis Data | ||||||||||||||||

Also see: |

| MSI Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| MSI Stock Price Chart |

| MSI Technical Analysis Charts |

|

| About Motorola Solutions Inc |

| Motorola Solutions is engaged in communications and analytics. Co.'s Products and Systems Integration segment provides a portfolio of infrastructure, devices, accessories, video security devices and infrastructure, and the implementation and integration of such systems, devices, and applications. Co. provides Long Term Evolution solutions for public safety, government and commercial users. Co.'s Video Security and Access Control technology includes network video management infrastructure, fixed security and mobile video cameras and access control solutions. Co.'s Software and Services segment provides a range of software and services for government, public safety and commercial customers. When researching a stock like Motorola Solutions, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MSI Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MSI stock — the real life supply and demand for the stock over time — and examines that data in different ways. |

| MSI Technical Analysis Charts |

|

| Video: Technical Analysis | |

|

| MSI Technical Analysis Peers |

| Motorola Solutions (MSI) is categorized under the Technology sector; to help you further research Technical Analysis, below are some other companies in the same sector:

MU Technical Analysis |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.