Monolithic Power Systems is a semiconductor company that designs, develops and markets semiconductor-based power electronics solutions. Co. designs, develops, markets, and sells semiconductor-based power electronics solutions for the computing and storage, automotive, industrial, communications and consumer markets. Co.'s main product families include: Direct Current (DC) to DC Products, which are used to convert and control voltages within a range of electronic systems; and Lighting Control Products, which are used in backlighting and general illumination products, and lighting control integrated circuits for backlighting are used in systems that provide the light source for LCD panels.

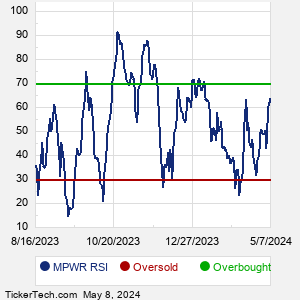

When researching a stock like Monolithic Power Systems, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MPWR Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MPWR stock — the real life supply and demand for the stock over time — and examines that data in different ways. |