Newmont is primarily a gold producer with operations and/or assets in the U.S., Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia and Ghana. Co. is also engaged in the production of copper, silver, lead and zinc. Co.'s North America segment consists primarily of Cripple Creek & Victor in the U.S. of America, Musselwhite, Porcupine and Eleonore in Canada and Penasquito in Mexico. Co.'s South America segment consists primarily of Yanacocha in Peru, Merian in Suriname, Cerro Negro in Argentina and its 40% equity interest in the Pueblo Viejo mine in the Dominican Republic. Co.'s Australia segment consists primarily of Boddington and Tanami in Australia.

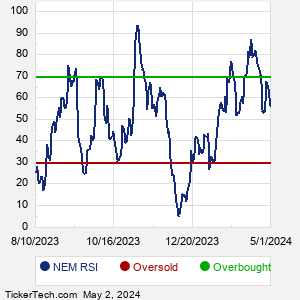

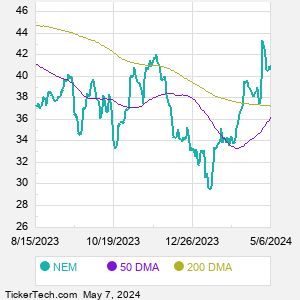

When researching a stock like Newmont, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from NEM Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for NEM stock — the real life supply and demand for the stock over time — and examines that data in different ways. |