NVIDIA has utilized its GPU architecture to create platforms for scientific computing, artificial intelligence (AI), data science, autonomous vehicles, robotics, and augmented and virtual reality. Co. has two segments: Graphics, which includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms, and Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; and Compute and Networking, which includes Data Center platforms and systems for AI, high-performance computing, and accelerated computing, Mellanox networking and interconnect solutions, and cryptocurrency mining processors.

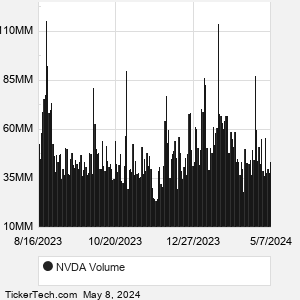

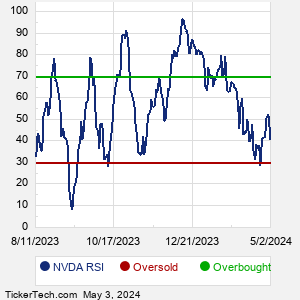

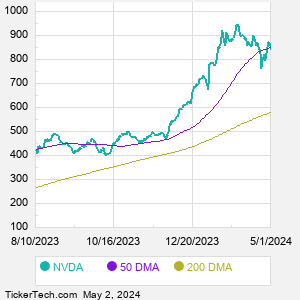

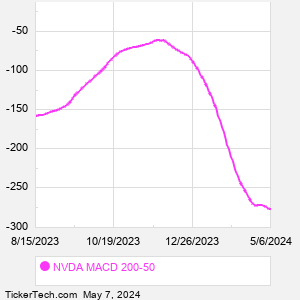

When researching a stock like NVIDIA, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from NVDA Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for NVDA stock — the real life supply and demand for the stock over time — and examines that data in different ways. |