Raymond James Financial is a bank holding company and financial holding company. Through its subsidiaries, Co. is engaged in various financial services activities. Co. has five segments: Private Client Group, which provides financial planning, investment advisory and securities transaction services; Capital Markets, which conducts investment banking, institutional sales, securities trading, equity research, and the syndication and management of investments; Asset Management, which provides asset management, portfolio management and related administrative services; Bank, which consists of Raymond James Bank, Fed member bank, and TriState Capital Bank; and Other.

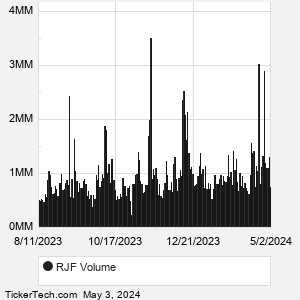

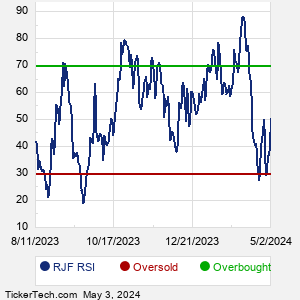

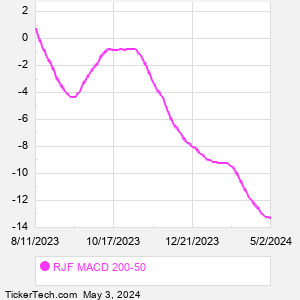

When researching a stock like Raymond James Financial, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from RJF Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for RJF stock — the real life supply and demand for the stock over time — and examines that data in different ways. |