Steel Dynamics is a steel producer and metal recycler in the U.S. Co. manufactures and sells steel products, processes and sells recycled ferrous and nonferrous metals, and fabricates and sells steel joists and deck products. Co.'s segments include: Steel Operations, which produce steel from ferrous scrap and scrap substitutes, utilize continuous casting, automated rolling mills and various steel coating and process lines; Metals Recycling Operations, which include both ferrous and nonferrous scrap metal processing, transportation, marketing, brokerage and scrap management services; and Steel Fabrication Operations, which serve the non-residential construction industry throughout the U.S.

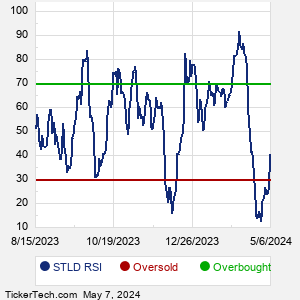

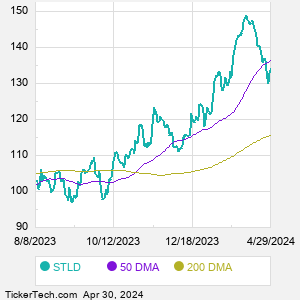

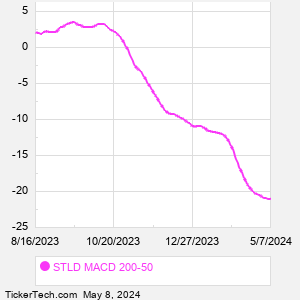

When researching a stock like Steel Dynamics, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from STLD Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for STLD stock — the real life supply and demand for the stock over time — and examines that data in different ways. |