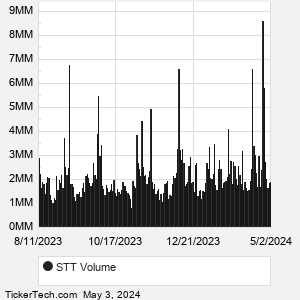

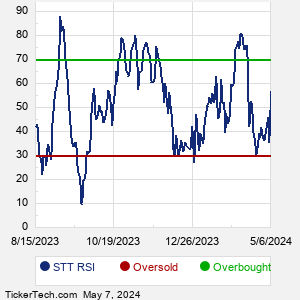

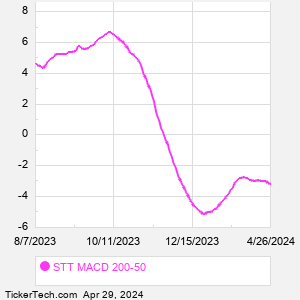

| STT Technical Analysis Data | ||||||||||||||||

Also see: |

| STT Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

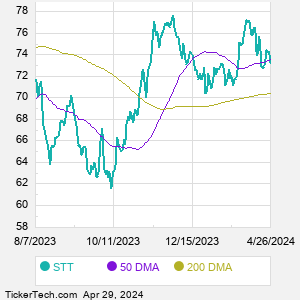

| STT Stock Price Chart |

| Technical Analysis News |

iShares Cybersecurity and Tech Getting Very Oversold PFFV Crosses Critical Technical Indicator SPDR S&P Insurance Getting Very Oversold Invesco CEF Income Composite Getting Very Oversold GBF Crosses Critical Technical Indicator PFLD Enters Oversold Territory PFFA Enters Oversold Territory SPDR Dow Jones Industrial Average Trust Getting Very Oversold Notable Two Hundred Day Moving Average Cross - VEEV WisdomTree Cloud Computing Fund (WCLD) Shares Cross Below 200 DMA BlackRock Debt Strategies Fund (DSU) Shares Cross Below 200 DMA CLOU Makes Notable Cross Below Critical Moving Average AUB Makes Notable Cross Below Critical Moving Average RAMP Crosses Below Key Moving Average Level TSLX Makes Notable Cross Below Critical Moving Average |