Trimble is a technology solutions provider. Co.'s work process solutions are used in architecture, building construction, civil engineering, geospatial, survey and mapping, agriculture, natural resources, utilities, transportation, and government. Co.'s segments are: Buildings and Infrastructure, which serves customers working in architecture, engineering, construction, and operations and maintenance; Geospatial, which serves customers working in surveying, engineering, and government; Resources and Utilities, which serves customers working in agriculture, forestry, and utilities; and Transportation, which serves customers working in long haul trucking and freight shipper markets.

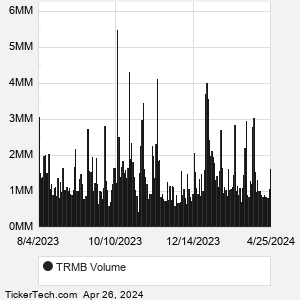

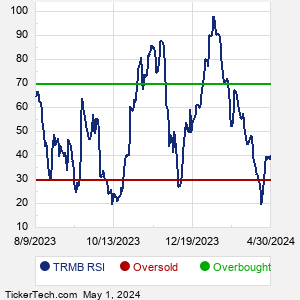

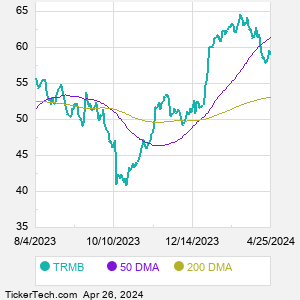

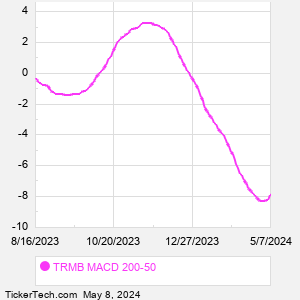

When researching a stock like Trimble, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from TRMB Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for TRMB stock — the real life supply and demand for the stock over time — and examines that data in different ways. |