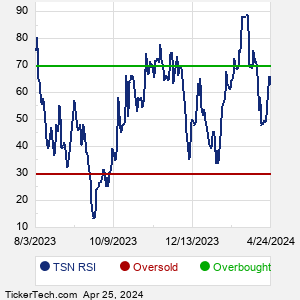

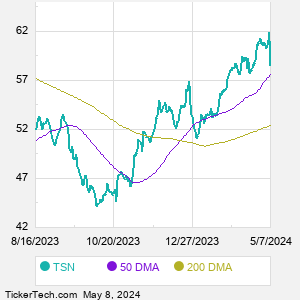

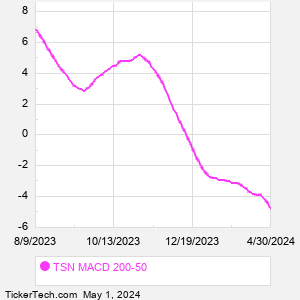

| TSN Technical Analysis Data | ||||||||||||||||

Also see: |

| TSN Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| TSN Stock Price Chart |

| Technical Analysis News |

ADI Makes Notable Cross Below Critical Moving Average Pathward Financial (CASH) Shares Cross Above 200 DMA Premier Financial Breaks Above 200-Day Moving Average - Bullish for PFC Shares of WINN Now Oversold Shares of XLY Now Oversold Shares of VUG Now Oversold VOT Crowded With Sellers The Technology Select Sector SPDR Fund (XLK) Enters Oversold Territory Shares of USSG Now Oversold AIQ Crosses Critical Technical Indicator Shares of DRIV Now Oversold UGIC Crosses Above Key Moving Average Level Shares of IVOG Now Oversold Shares of IGPT Now Oversold First Trust Technology AlphaDEX Fund Getting Very Oversold |