Vulcan Materials supplies construction aggregates (crushed stone, sand and gravel), a producer of asphalt mix and ready-mixed concrete, and a supplier of construction paving services. Co.'s products are the indispensable materials building homes, offices, places of worship, schools, hospitals and factories. Co.'s operating segments include: Aggregates, which produces and sells aggregates (crushed stone, sand and gravel, sand, and other aggregates) and related products and services; Asphalt, which produces and sells asphalt mix and includes asphalt construction paving; Concrete, which produces and sells ready-mixed concrete; and Calcium, which mines, produces and sells calcium products.

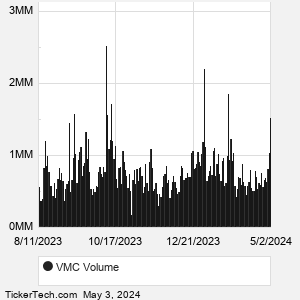

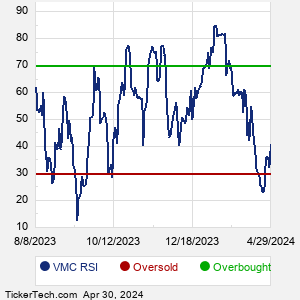

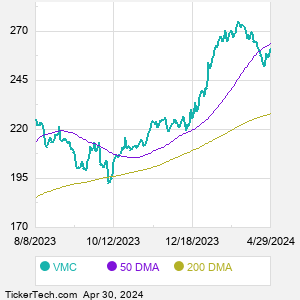

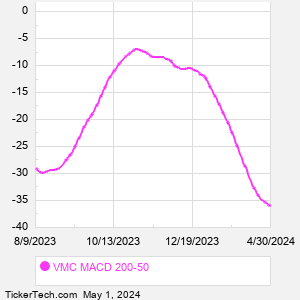

When researching a stock like Vulcan Materials, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from VMC Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for VMC stock — the real life supply and demand for the stock over time — and examines that data in different ways. |