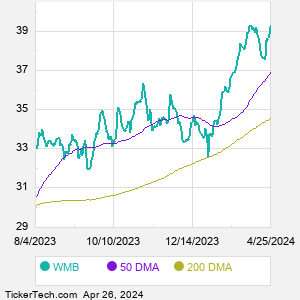

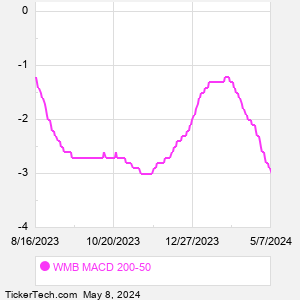

| WMB Technical Analysis Data | ||||||||||||||||

Also see: |

| WMB Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| WMB Stock Price Chart |

| Technical Analysis News |

COTY Crosses Above Key Moving Average Level CRI Crosses Above Key Moving Average Level KRG Makes Bullish Cross Above Critical Moving Average Quest Diagnostics (DGX) Shares Cross Above 200 DMA SRE Crosses Above Key Moving Average Level WTRG Makes Bullish Cross Above Critical Moving Average FMS Crosses Above Key Moving Average Level Simpson Manufacturing (SSD) Shares Cross Below 200 DMA Brandywine Realty Trust (BDN) Shares Cross Above 200 DMA DPST Makes Bullish Cross Above Critical Moving Average First Trust Ultra Short Duration Municipal Breaks Below 200-Day Moving Average - Notable for FUMB AGCO Shares Cross Above 200 DMA JPMB Shares Cross Above 200 DMA Hashicorp (HCP) Shares Cross Above 200 DMA EE Crosses Above Key Moving Average Level |