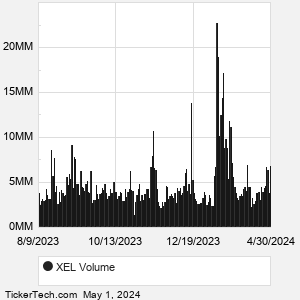

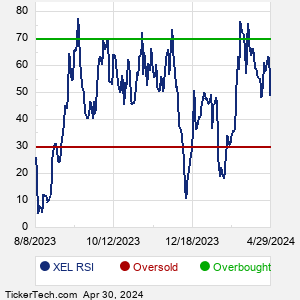

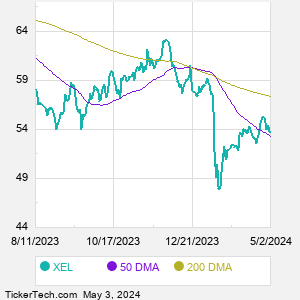

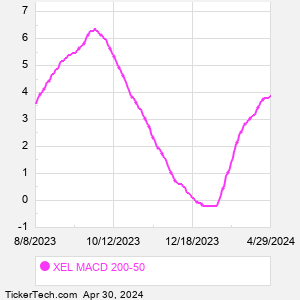

| XEL Technical Analysis Data | ||||||||||||||||

Also see: |

| XEL Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| XEL Stock Price Chart |

| Technical Analysis News |

ZYME Crosses Below Key Moving Average Level WVE Crosses Below Key Moving Average Level Notable Two Hundred Day Moving Average Cross - SUPN Paychex Breaks Below 200-Day Moving Average - Notable for PAYX TER Makes Notable Cross Below Critical Moving Average ACA Makes Notable Cross Below Critical Moving Average Notable Two Hundred Day Moving Average Cross - ALC BAK Makes Notable Cross Below Critical Moving Average SEACOR Marine Holdings (SMHI) Shares Cross Below 200 DMA INN Crosses Below Key Moving Average Level Brunswick (BC) Shares Cross Below 200 DMA PEB Crosses Below Key Moving Average Level FXH Crosses Below Key Moving Average Level UAN Crosses Below Key Moving Average Level APRW Enters Oversold Territor |