Analog Devices is a semiconductor company. Co. designs, manufactures, tests and markets a portfolio of solutions, including integrated circuits, software and subsystems. Co.'s products include: analog and mixed signal, which include data converter products; power management and reference, which include functions such as power conversion, driver monitoring, sequencing and energy management; amplifiers/radio frequency and microwave, which are used to condition analog signals; sensors and actuators; and digital signal processing and system products, which are designed to execute software programs, or algorithms, associated with processing digitized real-time, real-world data.

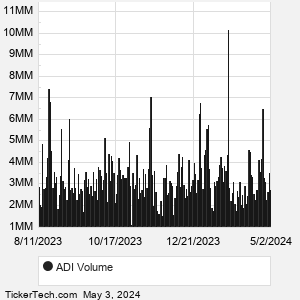

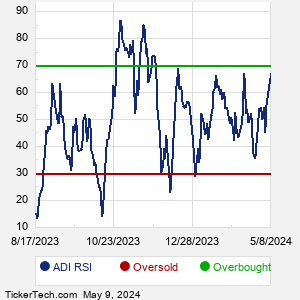

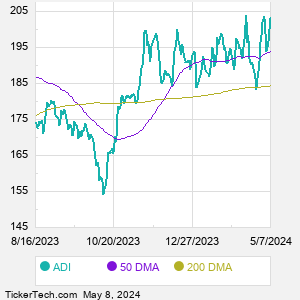

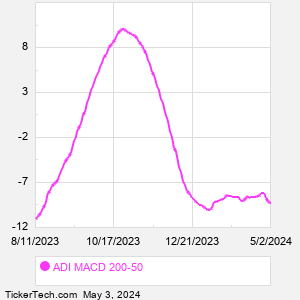

When researching a stock like Analog Devices, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from ADI Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for ADI stock — the real life supply and demand for the stock over time — and examines that data in different ways. |