International Paper is a producer of renewable fiber-based packaging and pulp products with manufacturing operations in North America, Latin America, Europe and North Africa. Co.'s businesses are separated into two segments: Industrial Packaging, which manufactures containerboard, such as linerboard, medium, whitetop, recycled linerboard, recycled medium and saturating kraft; and Global Cellulose Fibers, which is a producer of fluff pulp which is used to make absorbent hygiene products like baby diapers, feminine care, adult incontinence and other non-woven products.

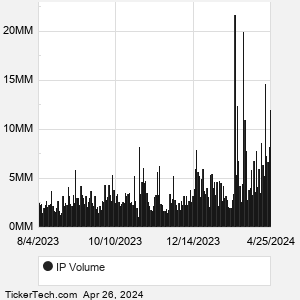

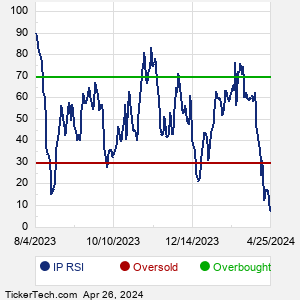

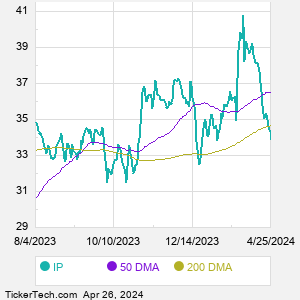

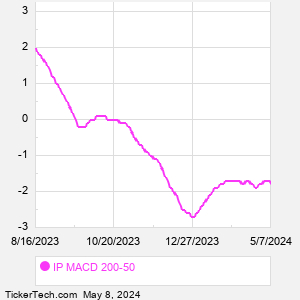

When researching a stock like IP, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from IP Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for IP stock — the real life supply and demand for the stock over time — and examines that data in different ways. |