Equifax is a data, analytics and technology company. Co. provides information solutions as well as human resources business process automation and outsourcing services. Co.'s segments are: Workforce Solutions, which includes services enabling customers to verify income, employment, educational history, criminal history, healthcare professional licensure and sanctions; U.S. Information Solutions, which provides consumer and commercial information solutions to businesses including online information, identity management services, analytical services and other services; and International, which provides information, technology and services to support debt collections and recovery management.

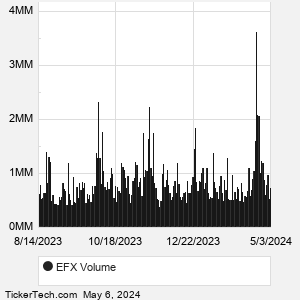

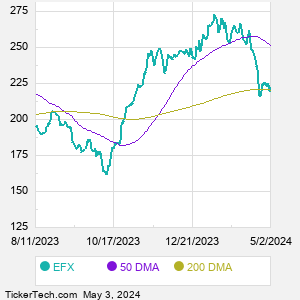

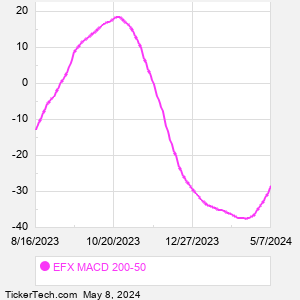

When researching a stock like Equifax, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from EFX Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for EFX stock — the real life supply and demand for the stock over time — and examines that data in different ways. |