GE HealthCare Technologies is a medical technology, pharmaceutical diagnostics, and digital solutions company. Co. has four segments: Imaging, which includes a portfolio of medical imaging solutions; Ultrasound, which includes ultrasound consoles and probes, handheld devices, intraoperative imaging systems, visualization software, service capabilities, and digital solutions; Patient Care Solutions, which includes monitoring, anesthesia and respiratory care, maternal infant care, and diagnostic cardiology solutions, consumables, service capabilities, and digital solutions; and Pharmaceutical Diagnostics, which are imaging agents that include contrast media and radiopharmaceuticals.

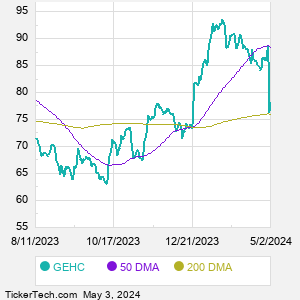

When researching a stock like GE Healthcare Technologies, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from GEHC Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for GEHC stock — the real life supply and demand for the stock over time — and examines that data in different ways. |