KeyCorp is a bank holding company. Through its subsidiary, KeyBank National Association and other subsidiaries, Co. provides a range of retail and commercial banking, commercial leasing, investment management, consumer finance, student loan refinancing, commercial mortgage servicing and special servicing, and investment banking products and services to individual, corporate, and institutional clients through two segments: Consumer Bank and Commercial Bank. In addition, Co.'s bank and its trust company subsidiary provide personal and institutional trust custody services, personal financial and planning services, access to mutual funds, treasury services, and international banking services.

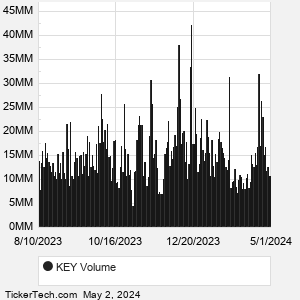

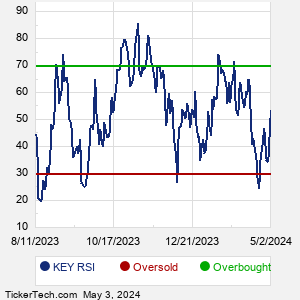

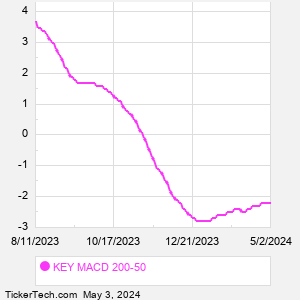

When researching a stock like KeyCorp, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from KEY Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for KEY stock — the real life supply and demand for the stock over time — and examines that data in different ways. |