Sysco, acting through its subsidiaries and divisions, is a distributor of food and related products to the foodservice or food-away-from-home industry. Co.'s segments include: U.S. Foodservice Operations, which includes U.S. Broadline operations that distribute food products, including custom-cut meat, seafood, produce, specialty Italian, specialty imports and non-food products, and U.S. Specialty operations; International Foodservice Operations, which includes operations in the Americas and Europe, which distribute food products and non-food products; and SYGMA, which is its U.S. customized distribution operations serving quick-service chain restaurant customer locations.

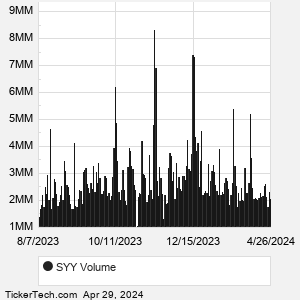

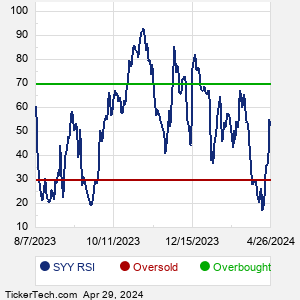

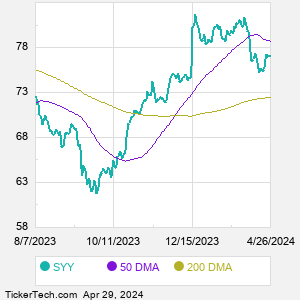

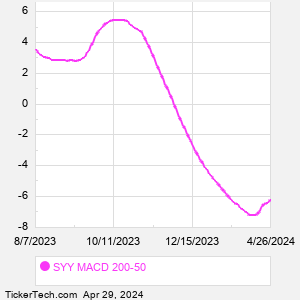

When researching a stock like Sysco, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from SYY Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for SYY stock — the real life supply and demand for the stock over time — and examines that data in different ways. |