Zimmer Biomet Holdings is engaged in musculoskeletal healthcare. Co.'s product categories include: Knees, which includes total knee replacement surgeries that typically include a femoral component, a patella (knee cap), a tibial tray and an articular surface (placed on the tibial tray); hips, which includes total hip replacement surgeries that replace both the head of the femur and the socket portion of the pelvis (acetabulum) of the natural hip; and Sports Medicine, Biologics, Foot and Ankle, Extremities and Trauma, and craniomaxillofacial and thoracic (CMFT), which includes sports medicine, biologics, foot and ankle, extremities, trauma and CMFT products.

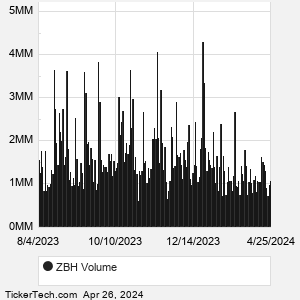

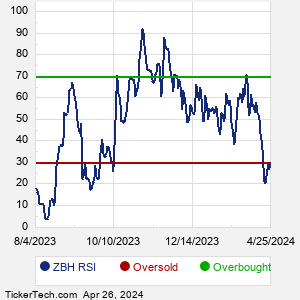

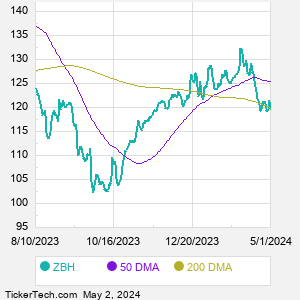

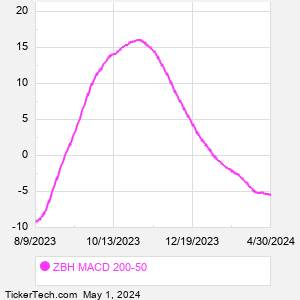

When researching a stock like Zimmer Biomet Holdings, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from ZBH Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for ZBH stock — the real life supply and demand for the stock over time — and examines that data in different ways. |