Ameriprise Financial is a holding company. Through its subsidiaries, Co. provides financial planning, products and services as solutions for clients' cash and liquidity, asset accumulation, income, protection and estate and wealth transfer needs. Co.'s segments are: Advice and Wealth Management, which provides financial planning and advice and brokerage services mainly to retail clients through its financial advisors; Asset Management, which provides investment management, advice and products to retail and institutional clients through Columbia Threadneedle Investments® brand; and Retirement and Protection Solutions, which provides clients annuities, life insurance and disability insurance.

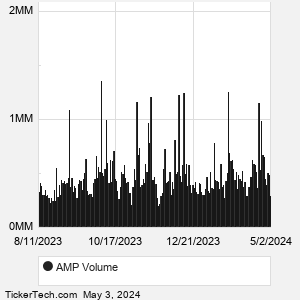

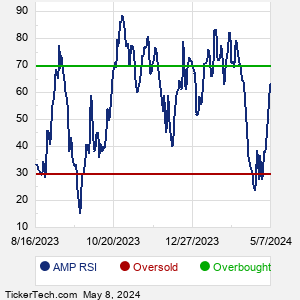

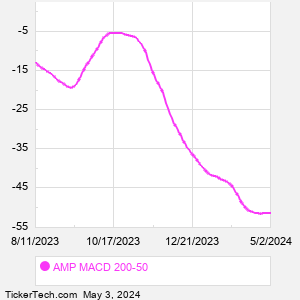

When researching a stock like Ameriprise Financial, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from AMP Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for AMP stock — the real life supply and demand for the stock over time — and examines that data in different ways. |