Arch Capital Group is a holding company. Through its subsidiaries, Co. provides insurance, reinsurance and mortgage insurance. Co.'s underwriting segments are: insurance, which includes construction and national accounts, excess and surplus casualty, lenders products, professional lines, programs, and property, energy, marine and aviation; reinsurance, which includes casualty, marine and aviation, other specialty, property catastrophe, and property excluding property catastrophe; and mortgage, which includes its U.S. primary mortgage insurance, U.S. credit risk transfer that are mainly with government sponsored enterprises and international mortgage insurance and reinsurance operations.

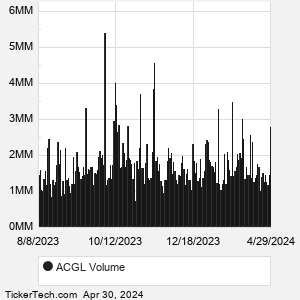

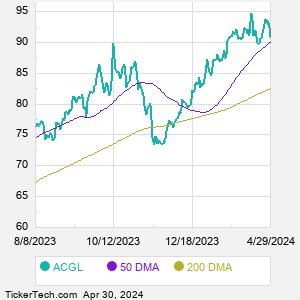

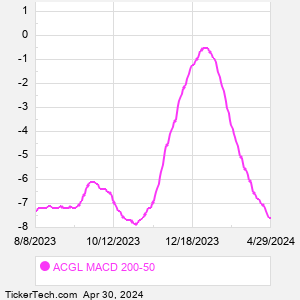

When researching a stock like Arch Capital Group, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from ACGL Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for ACGL stock — the real life supply and demand for the stock over time — and examines that data in different ways. |