| DFS Technical Analysis Data | ||||||||||||||||

Also see: |

| DFS Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| DFS Stock Price Chart |

| DFS Technical Analysis Data | ||||||||||||||||

Also see: |

| DFS Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| DFS Stock Price Chart |

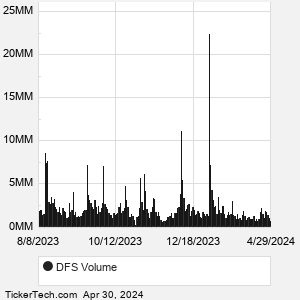

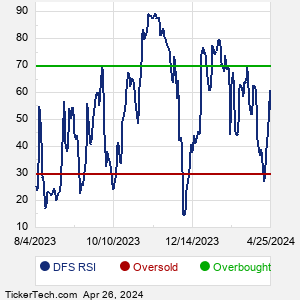

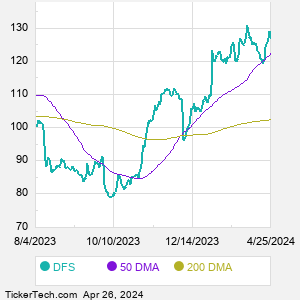

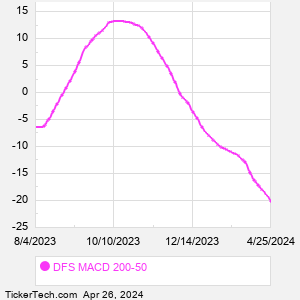

| DFS Technical Analysis Charts |

|

| About Discover Financial Services |

| Discover Financial Services is a bank holding company as well as a financial holding company. Co. provides digital banking products and services and payment services through its subsidiaries. Co. manages its business activities in two segments: Digital Banking, which includes consumer banking and lending products, mainly Discover-branded credit cards issued to individuals on the Discover Network and other consumer banking products and services, including private student loans; and Payment Services, which includes the PULSE network, Diners Club International and its Network Partners business that provides payment transaction processing and settlement services on the Discover Global Network. When researching a stock like Discover Financial Services, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from DFS Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for DFS stock — the real life supply and demand for the stock over time — and examines that data in different ways. |

| DFS Technical Analysis Charts |

|

| Video: Technical Analysis | |

|

| DFS Technical Analysis Peers |

| Discover Financial Services (DFS) is categorized under the Financials sector; to help you further research Technical Analysis, below are some other companies in the same sector:

DLR Technical Analysis |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.