General Mills is a manufacturer and marketer of branded consumer foods. Co.'s business is focused on snacks, ready-to-eat cereal, convenient meals, wholesome natural pet food, refrigerated and frozen dough, baking mixes and ingredients, yogurt, and ice cream categories. Co.'s segments include: North America Retail, which reflects business with a variety of grocery stores, mass merchandisers, membership stores, natural food chains, drug, dollar and discount chains, convenience stores, and e-commerce grocery providers; International, which reflects retail and foodservice business outside of the U.S. and Canada; and Pet, which includes pet food products sold primarily in the U.S. and Canada.

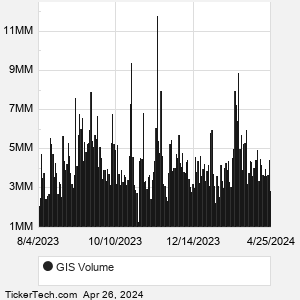

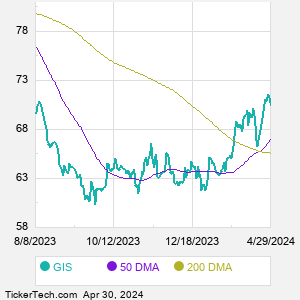

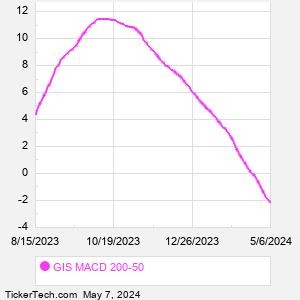

When researching a stock like General Mills, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from GIS Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for GIS stock — the real life supply and demand for the stock over time — and examines that data in different ways. |