Norwegian Cruise Line Holdings is a holding company. Through its subsidiaries, Co. is a cruise company which operates the Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises brands. Co.'s brands provide itineraries to worldwide destinations including Europe, Asia, Australia, New Zealand, South America, Africa, Canada, Bermuda, Caribbean, Alaska and Hawaii. Co.'s brands provide an assortment of features, amenities and activities, including a variety of accommodations, multiple dining venues, bars and lounges, spa, casino and retail shopping areas and various entertainment choices. Co. provides its guests a variety of cruise fare options when booking a cruise.

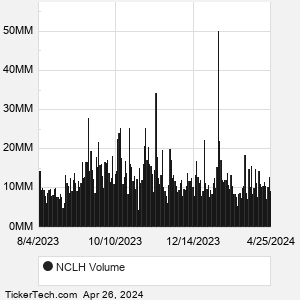

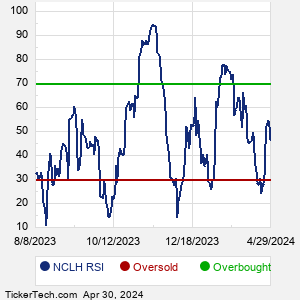

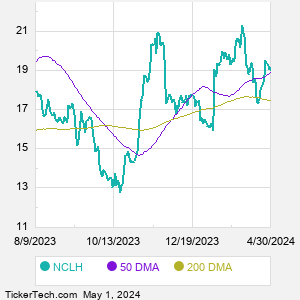

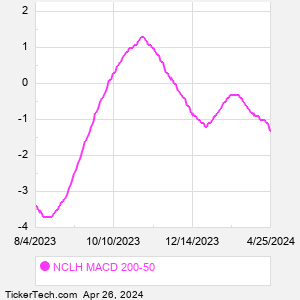

When researching a stock like Norwegian Cruise Line Holdings, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from NCLH Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for NCLH stock — the real life supply and demand for the stock over time — and examines that data in different ways. |