Weyerhaeuser is a real estate investment trust. Co.'s segments are: Timberlands, which provides delivered logs such as grade logs and fiber logs, timber, recreational leases and other products such as seed and seedlings grown and wood chips; Real Estate, Energy and Natural Resources (ENR), in which Real Estate sells timberland tracts and ENR grants rights to explore, extract and sell construction aggregates (rock, sand and gravel), industrial materials and natural gas; and Wood Products, which provides structural lumber, oriented strand board, engineered wood products, wood chips and other byproducts, and complementary building products such as cedar, decking, siding, insulation and rebar.

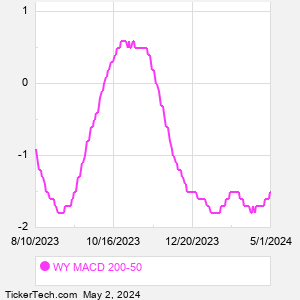

When researching a stock like Weyerhaeuser, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from WY Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for WY stock — the real life supply and demand for the stock over time — and examines that data in different ways. |