Deere & Co. operates several segments, including: Production and Precision Agriculture, which defines, develops, and delivers global equipment and technology solutions for growers of crops like large grains (such as corn and soy), small grains (such as wheat, oats, and barley), cotton, and sugarcane; Small Agriculture and Turf, which defines, develops, and delivers global equipment and technology solutions for dairy and livestock producers, crop producers, and turf and utility customers; and Construction and Forestry, which defines, develops, and delivers a range of machines and technology solutions organized along the earthmoving, forestry, and roadbuilding production systems.

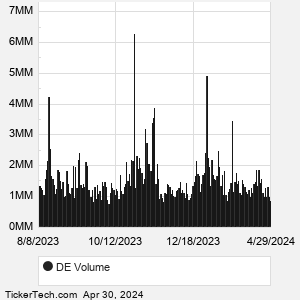

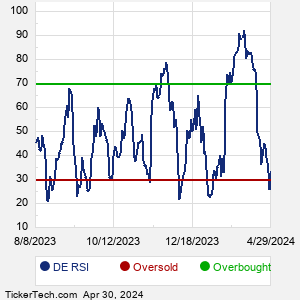

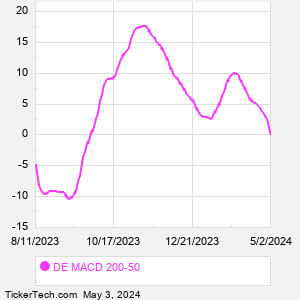

When researching a stock like Deere, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from DE Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for DE stock — the real life supply and demand for the stock over time — and examines that data in different ways. |