Honeywell International is a technology and manufacturing company. Co. has four segments: Aerospace, which supplies products, software and services for aircrafts; Honeywell Building Technologies, which provides products, software, solutions and technologies including building control and optimization, energy management, access control, video surveillance, fire products, and remote patient monitoring systems; Performance Materials and Technologies, which develops and manufactures chemicals and materials, process technologies and automation solutions; and Safety and Productivity Solutions, which provides products and software that improve productivity, workplace safety and asset performance.

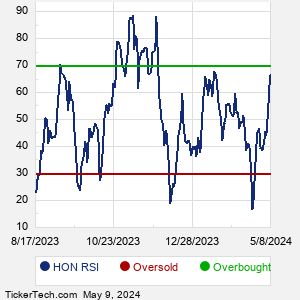

When researching a stock like Honeywell International, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from HON Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for HON stock — the real life supply and demand for the stock over time — and examines that data in different ways. |