Monster Beverage is a holding company. Through its subsidiaries, Co. develops, markets, sells and distributes energy drink beverages and concentrates for energy drink beverages. Co.'s segments are: Monster Energy® Drinks, which is comprised of Monster Energy® drinks, Reign Total Body Fuel® energy drinks, Monster® Tour Water™ and True North® Pure Energy Seltzers; Strategic Brands, which is comprised of various energy drink brands acquired from The Coca-Cola Company; Alcohol Brands, which is comprised of the various craft beers and hard seltzers; and Other, which is comprised of certain products sold by Co.'s subsidiary, American Fruits and Flavors LLC), to independent third-party customers.

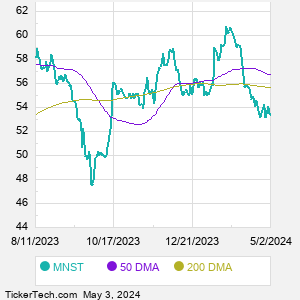

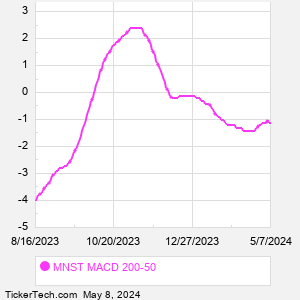

When researching a stock like Monster Beverage, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from MNST Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for MNST stock — the real life supply and demand for the stock over time — and examines that data in different ways. |